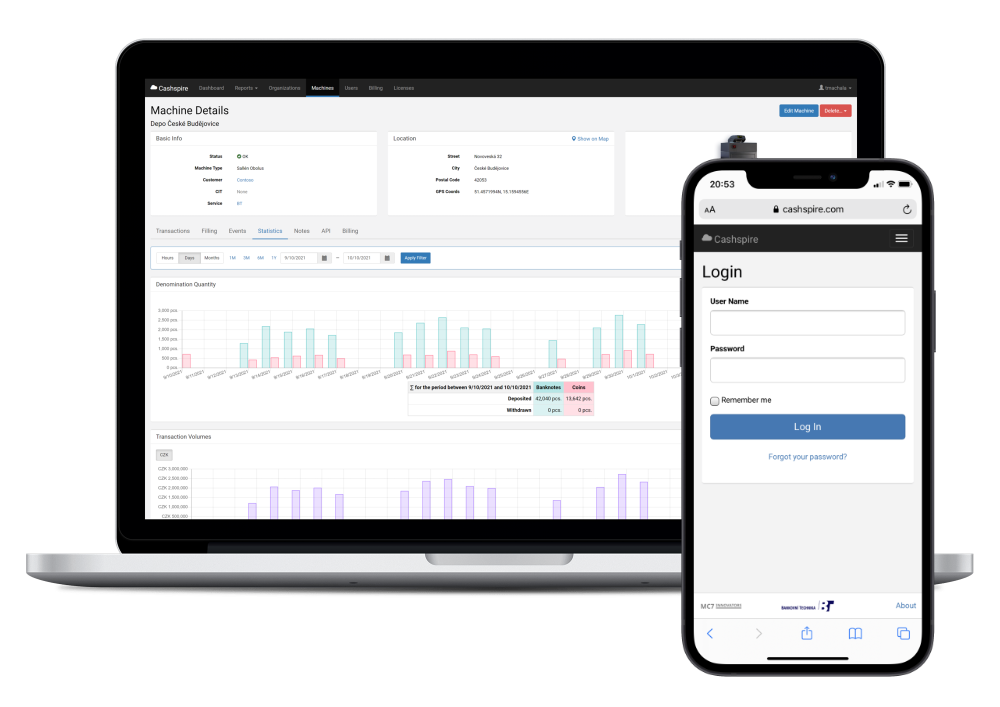

Case study: Cashspire

The integration platform for cash deposit terminals

Bankovní technika spol. s r.o.

Leading supplier of cash processing, protection and packaging solutions on the Czech market.

MC7 has been approached with an offer to collaborate on a project to create and operate a cloud-based solution for the integration of cash deposit terminals.

The aim of the project was to revolutionize the industry standard of the time, where individual manufacturers either offered no online connectivity to their deposit terminals at all, or the connectivity was limited only to their own IT systems, to which competitors' terminals could not be connected.

That conflicted with the real customers’ needs, who commonly combine terminals from several manufacturers. Customers were thus forced to spend a great deal of effort on integrating individual models, each coming with its own unique online service.

The purpose of Cashspire was therefore to offer a unified, open platform to which deposit terminals from different manufacturers could be connected and to make the data accessible in a unified way to the customers' own information systems, so that they do not have to deal with the technical nuances of individual models or connectivity problems in the case of remote or highly secured premises.

The project has been started by a two-week proof-of-concept.

Only 3 months from the first idea to the market.

The project has proven that even a small team of specialists can deliver a big business value.

We’re running the project successfully as SaaS since 2016.

MC7 created a cloud-based application that allowed three types of stakeholders to access depository terminal data:

The collaboration began in 2016 (originally under the legal entity that preceded today's MC7). After only 3 months from the initial idea, we delivered the first version of the application, the aim of which was to test the viability of the product. To get the product to market in such a short time, we have followed the MVP (Minimum Viable Product) approach. We have managed the project using Scrum methodology and our proven agile practices.

Although the product still lacked a refinement in the MVP state, its commercial viability became apparent very quickly thanks to the deep market knowledge that Bankovní technika brought to the project:

After the initial success, the cooperation continued. To this day, we are still developing the product and successfully operating it as a SaaS.

We designed the product from the beginning as a cloud-first application that we run in the Azure cloud environment. The solution also includes software that runs directly on the computers inside the cash deposit terminals. We have also successfully addressed the requirements of specific customers, such as banks that have very rigid security requirements.

Want to know more about this case study?Contact